Sberbank credit cards Mastercard and Visa Gold. Mastercard mass debit and credit card from Sberbank

Often, when placing an order in an online store, you can see that the types of cards from MasterCard are accepted: Mass, Gold, and Platinum.

What is MasterCard Mass? In fact, this is a card with identical conditions to MasterCard Standard. The prefix “Mass” often appears in official documents where processing is indicated, as bank employees themselves say.

As for the product from Sberbank, MasterCard is an international card used by both legal entities and individuals, which makes it possible to conduct transactions in more than 150 countries and make safe purchases online.

Additional services:

- mobile bank (allows you to manage funds on the card using a mobile phone);

- crediting funds to your account using ATMs;

- system of discounts provided during non-cash payments.

The balance can be topped up in several ways: using a bank, terminal, cash desk or using another card in online banking systems or payment systems (Yandex Money, Qiwi wallet). For cardholders, transactions such as depositing cash into the account (regardless of the type of currency), terminal payment for purchases, and a report on the current account status are free.

Overdraft

It is possible to obtain a credit card without an initial payment for a short period of time. That is, when carrying out non-cash transactions, it becomes possible to use the reserve of bank funds. This situation occurs when the client does not pay attention to the balance of funds in his account.

Within a period of exactly 55 days starting from the first day of the overdraft month, the borrower can return his money to the account without any extra charge. On all subsequent days when the money does not appear in the account at the appointed time, the interest will be 34% per annum.

Initially, overdraft was provided only to legal entities with a bank account, but now this scheme is also used by individuals.

Credit card

A MasterCard Mass credit card is issued for 3 years by a citizen of the Russian Federation who has reached the age of majority (21 years old) with permanent registration and an official source of income.

The service fee for the year is zero, and the cash withdrawal commission is 3% (>390 rubles), at ATMs of other financial organizations - 4%. Credit limit (the highest rate for spending) – 600,000 rubles.

Grace period for using funds (no interest) –< 50 дней, активен при осуществлении покупок. Выдача денег до 150 000 рублей в том же отделении банка, где была выдана карта, бесплатна.

If you carry out this operation in other branches of the Sberbank system, then a commission will be charged for withdrawing money from the account at a rate of 0.75% of the withdrawal amount.

Debit card

MasterCard Mass Sberbank debit is available only to adults (18 years old). It doesn’t matter to her whether she has Russian citizenship and permanent registration.

You need to write an application and, if approved, you select one of three types of currency in which you are going to store your funds: dollars, euros or rubles. You can choose depending on where you are going to use cashless payments.

It is possible to consistently accumulate bonuses for exchange for partner discounts. When submitting an application from the owner of the main card, it is also possible to issue an additional one. The limit on withdrawals per day is up to 300 thousand rubles.

Any citizen of Russia who reaches 14 years of age can also obtain an additional type of card. When registering it for a child or relative, his age must exceed 10 years.

Conditions of receipt

The main MasterCard Mass Sberbank card can be issued at each of the Sberbank branches subject to the following conditions:

- Reaching adulthood (18 years old).

- Permanent residence in the city where the card was purchased.

Usually, to apply for and receive a MasterCard Mass credit card from Sberbank, the only document required is a passport. If the bank requests other documents, bank employees will inform you in an additional manner. An important condition is that you will need to fill out an application for a card at a bank branch.

If you need to issue an additional card for your child or relative, he must be 10 years old. In this case, the owner of the main card must write the application himself.

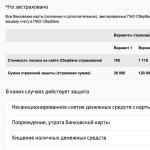

Maintenance cost

The price for servicing the card at the beginning of its operation and subsequently varies.

In the first year of use, the main (regardless of the selected currency) card will cost 600 ₽ (25 $/€), and an additional one - 360 ₽ (15 $/€). In the next years of operation of the card of the main type, the price for its maintenance will be 360 ₽ or 15 $/€, and for an additional one - 240 ₽ (10 $/€).

Advantages and disadvantages

Visible advantages of the card: there is no need for cash (as when using a non-cash account in general). Topping up your Sberbank MasterCard Mass account occurs without charging additional money. Using the card, you can make purchases both online and in a regular store. If the card is lost, it may be blocked; for this purpose, you must contact a branch of Sberbank of Russia.

There are several cost points that create a barrier to the use of this card and spoil the overall impression of it:

- the commission for cashing out money in Sberbank terminals will be 0.75%, in terminals of other banks - 1% (> 150 ₽ or 5 $/€).

- A paid service is also card blocking, which costs 1200 ₽ or 50 $/€.

- A report on the latest actions with the card is also not free; you can get it at an ATM for 15 rubles. For the loan to go negative, you will need to pay 34% per annum in rubles or 35% in dollars/euros.

Conclusion

Now cards called MasterCard Mass are not issued, and they are rarely seen anywhere.

MasterCard Standard is convenient when issuing a loan to a small business, that is, replenishing funds in the company’s circulation for a short period of time for the purpose of purchasing or manufacturing goods and their further sale.

Mastercard mass: Sberbank overdraft card September 11th, 2013

- rubles;

- dollars;

- Euro.

When issuing a currency card, the fee for its service will depend on the current exchange rate and will be equal to the ruble equivalent.

Registration of the main and additional Mastercard mass cards possible at any bank branch.

Sberbank for owners overdraft card Mastercard mass provides the opportunity to obtain a short-term loan without a down payment - an overdraft. This is an opportunity to use additional bank funds when making purchases. Within 55 days, the borrower can return the money to the account with a zero interest rate. In the following days, if the money does not arrive in the account on time, the interest rate will be calculated at 34% per annum.

How to use a Mastercard mass card correctly

Using any card has one golden rule: repay the loan on time and do not forget about annual maintenance. Then the card owner will never have credit debts or problems with his credit history.

Pros of using a card

- There is no need to carry cash with you.

- Refill Mastercard mass cards made at any receiving terminal, without commission.

- Using the card you can make purchases on the Internet. And when using it in the store, you will forget about the little things forever.

- If you lose your card, you can quickly block it by contacting any branch of Sberbank of Russia.

Disadvantages of using a card

- Commission for cash withdrawals is 0.75% at Sberbank ATMs, 1% at “other people’s” ATMs (or at least 150 rubles).

- Card blocking is a paid service (RUB 1,200).

- Also paid is a statement of the latest transactions on the card, obtained from an ATM (15 rubles).

When applying for a credit card, you must know all the intricacies of its use and the consequences of late use of credit funds.

And lastly. If you decide to take out a loan, are you rejected everywhere and don’t want to provide proof of income? Then take advantage of the joint promotion of our site.

Fill out the form and in 15 minutes a bank manager will contact you and offer the best conditions for obtaining a loan.

What's most interesting is that all this is provided completely free of charge! You don't have to pay for anything or anyone!

Hurry, the promotion will last for 1 month.

It's worth a try, don't miss your chance!

Let's look at what types of MasterCard Mass cards there are from Sberbank

Basic:

Any citizen of the Russian Federation can receive a basic MasterCard Mass card if he or she is over 18 years old.

In addition, the bank client must be registered in the city in which the branch or branch of Sberbank is located.

Additional:

A citizen of Russia can receive an additional MasterCard Mass card from Sberbank after he reaches fourteen years of age. True, in this case, the owner of the main card must write an application for such a card.

A close relative of the owner of the main one can also receive an additional card, provided that he is at least 10 years older.

How to get a MasterCard Mass card from Sberbank?

To receive a card, you just need to write an application at a bank branch and present your passport.

Card currency

MasterCard Mass cards can be opened in rubles, US dollars and euros.

Card maintenance costs:

1. For the first year of using the card, the service fee will be:

Main card (ruble, dollar and euro, respectively):

— 600 rubles:

— 600 rubles:

- 25 dollars;

- 25 euros.

Additional card:

— 360 rubles;

$15;

- 15 euros.

2. In subsequent years of use:

Main card: 360 rubles, 15 dollars or 15 euros depending on the currency of the card.

Additional card: 240 rubles, 10 dollars and 10 euros, respectively.

3. Free services for the cardholder:

— crediting funds to the card account in any currency;

— using the card for direct payment for goods and services through terminals;

— receiving a report on the card account.

4. The cost of an ATM statement about the last ten transactions is 15 rubles;

5. Fee for an overdraft that has arisen (going into the “minus” of the card), for which there is no limit - 34% per annum in rubles and 35% in dollars or euros;

6. Commission for blocking a card in case of its loss – 1200 rubles or 50 dollars;

7. For issuing “cash” through ATMs or Sberbank cash desks – 0.75% of the amount withdrawn;

8. If money is withdrawn from a “foreign” ATM – 1% of the amount, but not less than 150 rubles (5 dollars or 5 euros).

I would venture to note that the MasterCard Mass card from Sberbank can hardly be classified as “cheap and accessible”.

True, Sberbank states that such a card allows its owner to use additional services (for example, mobile banking, accepting payments through ATMs). But these are such trifles compared to the hefty costs of servicing the card!

I didn’t notice anything super new or revolutionary in this card - the most ordinary plastic with the most standard functions...

Alina Nazarova,

employee of a commercial bank, Moscow,

especially for website

MasterCard Electronic and MasterCard Unembossed cards are considered similar to the Mass (Standard) card. The peculiarity of such cards is that the data about them, as well as about...

Today, there are two most popular methods for making payments on the Internet - electronic money and virtual plastic cards (for example, MasterCard Prepaid and...

I have a photographer friend, and he says that photographers have an eternal debate about which is better - Canon or Nikon. And for users of plastic...

Each bank provides a range of commercial products that are designed for specific purposes. For example, these could be different loan packages, deposits, different cards for payments.

The largest bank in Russia, Sberbank, issues a whole range of bank cards. We will talk about them in this article. Read about which card you can apply for - "Visa" or "Mastercard" of Sberbank, how this procedure goes, and what is necessary in order to become the proud owner of a bank card.

Payment system type

As you know, in the field of bank cards the two most common payment systems are Visa and MasterCard. It is these systems that service the majority of cards issued by domestic banks. Most often, the number 1 bank in the country issues Mastercard cards. Sberbank, however, gives the client a choice - Visa can also be opened here.

In general, the type of payment system that the user chooses does not play as significant a role as the type of card. The names of tariffs and bonus programs that allow you to save on purchases are simply changed. Otherwise, the terms of service remain the same.

Card type

In addition to the differences in payment system, Sberbank issues Visa or MasterCard cards of different types. So, there are debit and credit. The first ones serve so that the client can store funds and accumulate them. In fact, in this case, the plastic card becomes the key to the bank account. With it, the client conducts transactions through the card (for example, withdrawing funds).

An alternative to a debit card is a Mastercard credit card. Sberbank issues cards of this type as a payment instrument for managing its credit limit. The card is a way to obtain a loan, the purpose of which is instant payment for the purchase of goods or services.

Difference

The difference between these two types of cards lies in several fundamental points. Firstly, this is the ownership of the money that is placed on them. If debit cards contain the client’s funds, then in the case of credit cards, this is the bank’s money. Secondly, the important difference is service. If in the case of a “credit card”, the client pays the interest on the account, then, since we are talking about debit cards, the bank (the owner of the money) pays for the use of funds. Thirdly, there is a difference in the possibility of withdrawal. Depending on the tariff at which the bank client is served, he may have the opportunity to withdraw funds at any time in the case of a credit card (provided that the resulting debt will be repaid in the future). And vice versa - some debit cards do not allow you to withdraw money at once (if it is a deposit account).

Card currency

The Mastercard card (Sberbank) may also differ depending on the currency of the funds on it. In this matter, everything is clear - a “ruble” account should be opened if the client is interested in a mobile payment instrument that can be used to pay at any time. As for other currencies, you should get cards that accept them in several situations. This could be: a trip abroad, payment on the Internet, the desire to save money, and so on.

Credit cards

So, what kind of Mastercard credit cards does Sberbank have? First of all, these are “youth” cards with a credit limit of up to 200 thousand and an interest rate of 33.9% per year. To get it, you need to confirm your income and pay 750 rubles a year for service. There are classic cards “Mastercard Standard” (Sberbank) or Visa Classic (from Aeroflot), with which the client can accumulate bonus miles for further flights cheaper (or free). There is a limit of 600 thousand, a rate of 25.9-33.9% (if you have a good reputation, you may be given a discount). Servicing the card costs 900 rubles.

There are “instant” credit cards that allow you to withdraw up to 120 thousand rubles at a rate of 25.9%. Service here can be free if you have a good reputation. The cards are called Momentum (“Mastercard”). Sberbank distributes them without proof of income.

Finally, there are cards for more demanding clients, the cost of servicing is about 3 thousand rubles. This is Mastercard Gold. Sberbank offers its users a wider range of options with such “gold” cards.

Debit cards

In addition to the credit cards described above, Sberbank also has a line of debit cards. In particular, it is a “virtual” card with which the user can make purchases on the Internet. There is no need to physically register it. Next comes, for example, a Mastercard card (Sberbank) with an individual design (service costs 1,250 rubles). There are also classic cards (cost 750 rubles). They are called Visa Classic and MasterCard Standard. They include a basic set of services (customer support related to servicing a bank account).

Finally, there are “gold” and “platinum” cards Visa/MasterCard Gold and Platinum. The cost of the former is 3000 and 3500 per year, the latter - 15 and 10 thousand. The difference in the price of card content is due to various additional options, for example, the payment function using PayWave technology.

Special cards

In addition to those listed above, there are also various so-called social or affiliate cards. The first are those intended to service pensions. The cost of servicing on such a card is zero, and 3.5 percent per annum is charged on the balance on it. In addition, there are various special opportunities, for example, bonuses in stores when paying with such a card, promotions and discounts.

Another example is cards from partners. We have already mentioned them. This is an Aeroflot card for accumulating miles and the Gift of Life fund. The peculiarity of the latter is that the money received from the owner is transferred to charity (for the treatment of seriously ill children).

There is also, for example, the opportunity to open a special card for a child, which will be linked to the parent’s account. With its help, children will be able to make purchases, pay for them, receive discounts for this and accumulate bonuses.

How to choose?

Having seen such a list of bank cards available for opening, you might think that there will be a problem when choosing the one you would like to issue. There is a special constructor on the Sberbank website that will help you with your choice. It is very easy to use.

It is enough, firstly, to decide: you want to take money from the bank on credit, or open an account into which you deposit the funds yourself. Secondly, you need to think about what type of card you are interested in - do you need a simple, “classic”, or some kind of “elite” (Gold) card. Considering this, make a choice in favor of one product or another.

As a last resort, if you do not know what this or that opportunity on the card means, remember: you can always contact a bank employee with a request for advice and a hint about which card you need.

The most common credit card today is the MasterCard credit card from Sberbank. You can use it to pay at many trading organizations and transfer money from one account to another using it. For the convenience of clients, Sberbank has increased the network of its own ATMs and payment terminals. Now in every city in our country there are at least several ATMs of this bank. This card can be used by Russian citizens, both in our country and abroad. VIP clients of the bank can get a MasterCard Gold credit card. It has a larger cash limit and gives more privileges to its owner.

Where and how to apply

You can apply for this in all branches. The client only needs to have a passport with him. In this case, the decision to issue a card will come from the bank within 2 - 3 days, and the issuance of a card can last up to 3 weeks. The MasterCard credit card from Sberbank is issued only to citizens over 18 years of age. They must also have a permanent job and a stable income. If you don’t want to waste time going to the bank, you can leave an online application on the Sberbank website. To do this, you need to fill out a short form and submit it for consideration. After this, a specialist will contact you and discuss further actions.

Credit card terms

The MasterCard credit card issued by Sberbank has a grace period of up to 50 days. During this period, you can spend money from the card and put it back without paying interest. After the grace period ends, a fixed interest rate of 24% per annum will apply. The limit size of this card can be between 10 and 300 thousand rubles. If you decide to withdraw cash from this card at Sberbank ATMs, you will be charged a commission of 3% of the withdrawal amount. But if you withdraw money from this card at ATMs of third-party banks, you will pay a 4% commission. You can repay the debt on this card through, through the cash desks of this bank, or by bank transfer from an account in another bank.

Who can get a Mastercard card

To receive this card, you do not have to be a current Sberbank client. It is enough to be a Russian citizen and have more than six months of work experience. You also need to be permanently registered in the region where you receive the card. A MasterCard credit card is issued to men from 21 to 57 years of age, and to women from 21 to 53 years of age. In this case, confirmation of the client’s solvency is often not required. Apply for this credit card today and enjoy its benefits!